Get Trn Application Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trn Application Form online

Completing the Trn Application Form online can be a straightforward process when you have the right guidance. This guide will walk you through each section of the form, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete your application online

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

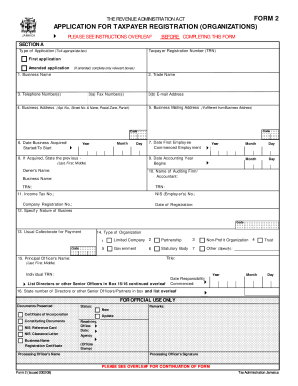

- Begin by selecting the type of application you are submitting. Indicate whether this is a first application or an amended application by marking the appropriate box.

- Enter the Taxpayer Registration Number (TRN) if applicable, along with the business name and trade name in the designated fields.

- Provide your contact information, including telephone numbers, fax number, and email address.

- Fill out the mailing address if it differs from the business address. Ensure you include complete details like apartment number, street name, postal zone, and parish code.

- Record the date your business was acquired or started. Specify the day, month, and year in the respective fields.

- Indicate the date your first employee commenced employment using the same date format.

- If your business was acquired, state the previous business name in the allotted section.

- Specify the accounting year start date, ensuring to follow the required date format.

- Provide details about your auditing firm or accountant, including their business name and Taxpayer Registration Number.

- Include additional identification numbers such as Income Tax Number, NIS (Employer's) Number, and Company Registration Number, along with the date of registration.

- Outline the nature of your business by specifying the relevant code.

- State the usual collectorate for payment.

- Select the type of organization by checking the appropriate box, whether it’s a partnership, limited company, non-profit organization, etc.

- Provide the principal officer's name, including their last name, first name, and middle name, followed by their individual TRN.

- List the directors or other senior officers/partners, completing additional fields for each individual as necessary.

- If your business has branches, indicate the number of branches and ensure to complete an additional form for each branch.

- In Section B, declare that the information you provided is true to the best of your knowledge, including your name, signature, title, and date.

- Once you have filled out all relevant sections, review the form for accuracy. Then, save your changes or download the form as necessary. You may also print or share it as required.

Complete your Trn Application Form online today to ensure your business is registered correctly.

A TRN, or Taxpayer Registration Number, is essential for individuals conducting business or engaging in financial activities in Jamaica. This number helps streamline tax collection and ensure compliance with local tax laws. By applying for a TRN using the Trn Application Form, you secure your ability to operate legally within the financial landscape of Jamaica. It is an important step in managing your tax obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.