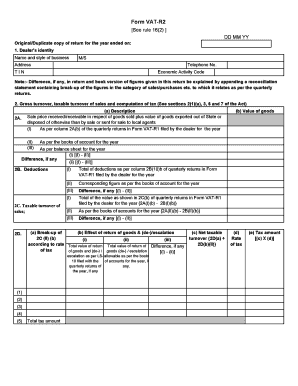

Get Haryana Vat Utility Download

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Haryana Vat Utility Download online

How to fill out and sign Haryana Vat Utility Download online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The era of worrying over intricate legal and tax paperwork is finished. With US Legal Forms, the complete procedure of generating legal documents is stress-free. A powerful editor is readily available offering you a broad range of useful tools for filling out a Haryana Vat Utility Download. These instructions, along with the editor, will assist you throughout the entire procedure.

There are several options for obtaining the document: as an immediate download, as an attachment in an email, or by mail as a printed copy. We simplify the process of completing any Haryana Vat Utility Download. Begin now!

- Click on the Get Form button to begin altering.

- Activate the Wizard mode on the upper toolbar to receive additional advice.

- Complete each fillable section.

- Ensure the information you provide in the Haryana Vat Utility Download is accurate and current.

- Specify the date on the form using the Date feature.

- Press the Sign icon and create a digital signature. You can choose from 3 available options: typing, drawing, or uploading one.

- Verify that each field has been filled out properly.

- Select Done in the upper right corner to save the document.

How to Modify Get Haryana Vat Utility Download: Personalize Forms Online

Sign and distribute Get Haryana Vat Utility Download along with any additional business and personal documents online, saving time and resources that would otherwise go to printing and mailing. Maximize the use of our online form editor featuring a built-in compliant eSignature option.

Electronic approval and submission of Get Haryana Vat Utility Download documents is faster and more efficient than handling them in hard copy. Nevertheless, it necessitates using online solutions that guarantee a high level of data security and offer a compliant mechanism for generating electronic signatures. Our robust online editor is precisely what you need to finalize your Get Haryana Vat Utility Download and other personal or business tax documents accurately and appropriately in line with all requirements.

It provides all essential tools for swiftly and effortlessly filling out, modifying, and signing documents online while incorporating Signature fields for other participants, indicating who should sign and where.

Distribute your documents to others using one of the available options. When confirming Get Haryana Vat Utility Download with our powerful online editor, you can always trust it will be legally binding and admissible in court. Prepare and submit documents in the most advantageous manner!

- Open the chosen document for further modification.

- Utilize the top panel to incorporate Text, Initials, Image, Check, and Cross indicators into your template.

- Emphasize the crucial details and censor or eliminate sensitive information if necessary.

- Click on the Sign option above and choose how you prefer to eSign your document.

- Draw your signature, type it, upload an image of it, or select another option that suits you.

- Navigate to the Edit Fillable Fields panel and place Signature sections for other individuals.

- Click on Add Signer and enter your recipient’s email to designate this field to them.

- Ensure that all information provided is comprehensive and accurate before you click Done.

The due date for VAT payment in Haryana typically falls on the 21st day of the month following the end of the quarter. It is crucial to keep track of these dates to avoid late fees. Access the Haryana tax portal regularly for updates or any changes. Using the 'Haryana VAT Utility Download' can help you stay organized with your payment schedule.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.