Loading

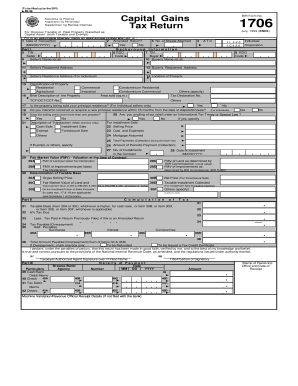

Get Bir Form 1706 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1706 online

This guide provides clear and detailed instructions on filling out the Bir Form 1706 online, ensuring that you understand each component of the form. By following these steps, you can complete your Capital Gains Tax Return effectively and accurately.

Follow the steps to accurately complete the Bir Form 1706.

- Press the ‘Get Form’ button to access the form, which you will then open in your preferred online editor.

- Enter the date of the transaction in the format MM/DD/YYYY. This date refers to when the sale occurred, not when you are filing the return.

- Indicate whether the return is amended by marking the appropriate box. Fill in the number of sheets attached if there are additional documents to submit.

- Complete the classification of the property being sold by selecting the appropriate type such as residential, commercial, or agricultural.

- Answer all questions regarding the use of the property, such as whether it is your principal residence or if you plan to acquire a new one.

- In Part II, calculate the taxable base by entering the appropriate amounts in the specified fields and doing the necessary computations.

- Review all sections of the form for accuracy. Make sure to sign above your printed name as the taxpayer or authorized agent.

Complete your Bir Form 1706 online now to ensure timely processing and compliance with tax regulations.

The $3000 capital loss rule permits taxpayers to deduct up to $3000 in capital losses from their taxable income each year. For married couples filing jointly, the limit doubles to $6000. Recognizing these limits can help minimize your tax burden and is important when preparing your BIR Form 1706.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.