Loading

Get Debit Note Format 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Debit Note Format online

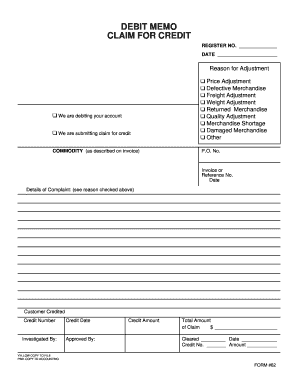

This guide provides a clear and supportive overview of how to complete the Debit Note Format online. By following these instructions, users can efficiently fill out the necessary information for their debit note.

Follow the steps to complete the Debit Note Format

- Click ‘Get Form’ button to obtain the Debit Note Format and open it in the editor.

- Fill in the register number in the designated field to uniquely identify your transaction.

- Enter the date of the debit note in the corresponding section to document when the claim is being made.

- Select the reason for adjustment from the options provided, such as 'Defective Merchandise' or 'Price Adjustment.'

- Complete the commodity section as described on the invoice to clarify what is being adjusted.

- Input the purchase order number (P.O. No.) to link the debit note with the original purchase.

- Provide the invoice or reference number and date to ensure accurate documentation of the transaction.

- Detail the complaint in the designated area, referencing the reason for the adjustment checked above.

- Fill in the customer credited and credit number fields to keep track of the credited amount.

- Enter the credit date to document when the credit was processed.

- Provide the name of the person who investigated the claim in the 'Investigated By' section.

- The approved by section should be completed by the authorized individual overseeing the approval.

- Input the credit amount and total amount of claim in the specified fields for financial tracking.

- Once you have filled out all necessary fields, review the form for accuracy and completeness.

- Finally, you can save the changes, download, print, or share the completed form as needed.

Complete your debit notes online with confidence and accuracy.

Filling a debit note involves including specific details such as the transaction date, a description of the items being adjusted, and references to the original invoice. Make sure to provide both your information and the seller's details clearly. This structured approach helps in maintaining coherent financial documentation. Adhering to a standardized debit note format makes this task easier and prevents errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.