Get P60 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P60 online

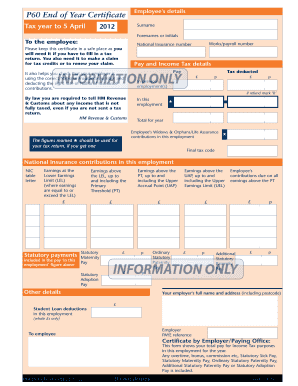

The P60 is an essential document that summarizes an employee's total pay and deductions for the tax year. This guide will provide clear, step-by-step instructions on how to complete the P60 online, ensuring you have all the necessary information at hand for tax returns or claims.

Follow the steps to successfully complete your P60 online:

- Press the ‘Get Form’ button to access the P60 document and open it for editing.

- Begin by entering your surname in the designated field to ensure the document accurately reflects your identity.

- Input your forenames or initials in the appropriate section, providing your full name as it appears on official records.

- Fill in your works/payroll number to allow your employer to identify your records correctly.

- Enter your National Insurance number to confirm your contributions are correctly documented.

- Review the pay section, where you will see your total pay for the year; ensure these figures are accurate.

- In the tax deducted section, verify and input the total income tax that has been taken from your earnings.

- If you had any previous employment during the tax year, indicate this in the section provided and mark as ‘R’ if applicable.

- Complete the sections concerning statutory payments (like Statutory Maternity Pay and Statutory Sick Pay) if they apply to you.

- Check the contributions for any additional insurances or deductions, ensuring all figures are accurate.

- Lastly, review your employer’s full name and address, including the postcode, and ensure the PAYE reference is correctly entered.

- Once all sections are filled out correctly, save your changes, then choose to download or print the P60 for your records.

Begin your online completion of the P60 document today to ensure accurate tax reporting.

To run a P60 in QuickBooks, you will first need to ensure that your payroll settings are correctly configured. Access the payroll menu, and select the option to generate a P60 report for your employees. QuickBooks provides a user-friendly interface that simplifies the reporting process. If you need further help with payroll features in QuickBooks, check out the resources available at US Legal Forms for additional guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.