Loading

Get Isp1640 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Isp1640 online

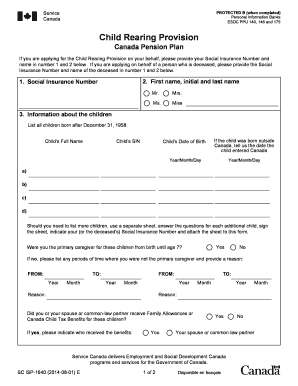

The Isp1640 form is an important document for individuals applying for the Child Rearing Provision under the Canada Pension Plan. This guide provides a clear, step-by-step approach to assist users in completing the form accurately and efficiently online.

Follow the steps to successfully fill out the Isp1640 online

- Press the ‘Get Form’ button to access the Isp1640 form and open it in your preferred online editor.

- Fill in your Social Insurance Number and your name in the first two fields. If you are completing the form on behalf of a deceased person, provide their Social Insurance Number and name.

- In the section labeled 'Information about the children,' list all relevant children born after December 31, 1958. For each child, provide their full name, date of birth, and Social Insurance Number. If a child was born outside of Canada, include the date they entered Canada.

- Indicate whether you were the primary caregiver for these children from birth until age seven. If no, list any periods of time when you were not the primary caregiver, including reasons and dates.

- Answer if you or your spouse or common-law partner received Family Allowances or Canada Child Tax Benefits for the listed children. If yes, specify who received the benefits.

- Continue with the next section by listing any periods of time during which you did not receive Family Allowances or Canada Child Tax Benefits for these children and provide reasons.

- If applicable, provide a signature along with the date, ensuring to state that the information provided is true and complete. Include your contact telephone number.

- If completing the form on behalf of a deceased individual, enter your name and telephone number, and include an address.

- If claiming a waiver of rights, the eligible individual must complete the waiver section by providing necessary details, including their signature and date.

- After completing all sections, save your changes, and choose an option to download, print, or share the filled form.

Start filling out your Isp1640 online today for an efficient application process.

The break-even point for taking CPP typically falls around age 65 to 70, depending on your circumstances and when you choose to start receiving benefits. If you take CPP earlier, you may receive lower monthly payments over a longer period. Consulting with Isp1640 can help you evaluate your options and find the best strategy for your retirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.