Loading

Get Dol 3c 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dol 3c online

Filling out the Dol 3c form online can streamline the process of correcting and reporting wages efficiently. This guide provides clear, step-by-step instructions designed to help you complete the form accurately and confidently.

Follow the steps to fill out the Dol 3c form successfully.

- Click ‘Get Form’ button to access the Dol 3c form and open it in your preferred online editor.

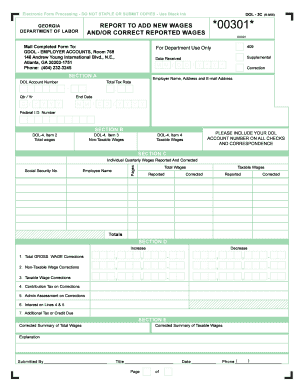

- In Section A, enter your DOL Account Number, followed by the total tax rate which includes the contribution plus administrative assessment. Specify the quarter and four-digit year, fill in the quarter ending date, and provide your Federal I.D. Number. Additionally, include your employer name, address, and email.

- Proceed to Section B and input the amounts as they were originally reported for taxable and non-taxable wages according to items 2, 3, and 4 of the Employer’s Quarterly Tax and Wage Report, Form DOL-4.

- In Section C, provide the Social Security Numbers and names of any employees whose wages were omitted or reported incorrectly. Note the page number where they were originally reported. Here, you should enter the total wages reported and the corrected amounts for each employee, including taxable wages.

- For Section D, calculate and enter the differences between reported and corrected wages as either increases or decreases in lines 1 to 3. Follow up with the corresponding calculations for contribution and administrative taxes based on the tax rates applicable to the quarter.

- Complete Section E by adjusting the totals for gross and taxable wages based on the differences noted previously. Provide an explanation for your adjustments in the available space.

- Finally, fill in the 'Submitted By' section with your name, title, date, and telephone number, then review your form for accuracy before submitting it as instructed.

Complete your Dol 3c form online today to ensure timely and accurate wage reporting.

Yes, unemployment benefits are taxable in Georgia just like they are at the federal level. When filing your state tax return, you must include any unemployment benefits received. It's wise to be prepared for this obligation, and the Dol 3c can assist you in understanding how to report these benefits properly and avoid any potential issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.