Loading

Get Chhsa Form Sar 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Chhsa Form Sar 2 online

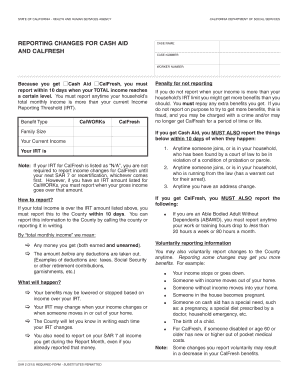

Filling out the Chhsa Form Sar 2 online is an essential step for users receiving Cash Aid and CalFresh benefits. This guide provides a clear and supportive framework to help you understand each component of the form.

Follow the steps to complete the Chhsa Form Sar 2 online.

- Click the ‘Get Form’ button to access the Chhsa Form Sar 2. This will allow you to open the form in an online editor.

- Fill in the 'Case Name' field with the name associated with your benefits. Ensure that this information is accurate and up to date.

- Enter your 'Case Number' in the designated field. You can find this number on previous correspondence regarding your benefits.

- Input your 'Worker Number.' This number is typically provided by your caseworker and identifies your case.

- Indicate your type of benefits by checking the appropriate box for 'CalWORKs' or 'CalFresh.' Ensure you understand the obligations for each type.

- Provide information about your family size in the 'Family Size' section. This is critical for determining your eligibility and benefit amount.

- Write down your 'Current Income.' Include total income before deductions. If your income exceeds the Income Reporting Threshold (IRT), you need to take additional steps.

- Review the note regarding CalFresh if your IRT reads 'N/A.' Understand your reporting requirements as they apply to your specific benefits.

- Check for additional requirements, such as voluntary reporting, and include any changes in your circumstances that might affect your benefits.

- Once all fields are completed, save your changes. You have the option to download, print, or share the form as needed.

Complete your documents online today to ensure your benefits remain properly reported and in good standing.

Submitting your SAR 7 online in California is easy and can be done via the CalFresh benefits portal. After logging in, locate the section for submitting your SAR 7 report. Ensure that you complete all necessary sections and have your Chhsa Form Sar 2 ready for reference. This process is essential for maintaining your eligibility and keeping your benefits active.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.