Get Get The Form Dr0104ad 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Get The Form Dr0104ad online

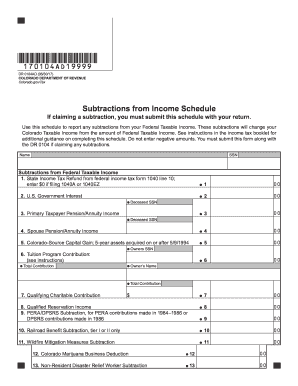

The Get The Form Dr0104ad is a crucial schedule used for reporting subtractions from your Federal Taxable Income to calculate your Colorado Taxable Income. This guide provides clear, step-by-step instructions for completing the form online, ensuring accuracy and understanding.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the 'Name' field, enter your full name as it appears on your tax documents.

- In the 'SSN' field, provide your Social Security Number to ensure proper identification.

- For line 1, report the state income tax refund from federal form 1040 line 10 or enter $0 if you are filing 1040A or 1040EZ.

- Continue with line 2 by indicating any U.S. Government Interest you are eligible to subtract.

- For lines 3 and 4, enter your pension or annuity income for both the primary taxpayer and spouse, if applicable, along with respective deceased SSNs.

- In line 5, report any Colorado source capital gain that qualifies under the specified conditions.

- For line 6, fill out the tuition program contribution and include the owner's SSN as necessary.

- Proceed to enter any specified amounts for lines 7 through 15, ensuring that you refer to the instructions provided for any special conditions or details.

- Once all necessary information is completed, calculate the subtotal by adding lines 1 through 15, then transfer this amount to line 5 on the DR 0104.

- Finally, review all entries for accuracy, then save, download, print, or share the completed form as required.

Complete your documents online efficiently and accurately today!

To fill out an employee's withholding certificate, begin by entering the employee's name, address, and Social Security number. Then, the employee should indicate their filing status and desired number of allowances. Make sure the employee reviews their entries for accuracy before submission. This form is crucial for determining proper federal tax withholdings, and obtaining clarity can be achieved through hosting tools like uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.