Get 8821a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8821a online

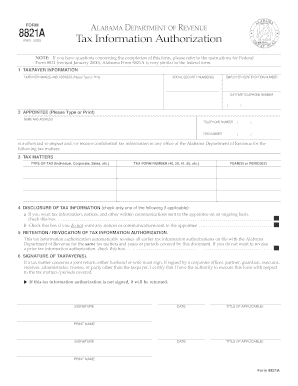

Form 8821a is essential for individuals and entities wanting to authorize someone to receive their confidential tax information from the Alabama Department of Revenue. This guide will provide you with clear, step-by-step instructions on how to complete the form online.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the 8821a document and open it in the editor of your choice.

- In the first section, 'Taxpayer Information,' enter your name(s) and address in the designated fields. Ensure that the information is typed clearly.

- Proceed to the 'Appointee' section. Here, specify the name and address of the individual you are authorizing. Include their telephone number and fax number in the respective fields.

- In the 'Tax Matters' section, identify the type of tax relevant to your situation (e.g., individual, corporate, sales) and provide the corresponding tax form number, including the years or periods it covers.

- For 'Disclosure of Tax Information,' select one of the provided options. Check the box if you want tax information and communications sent to the appointee, or check the other box if you do not want any information sent.

- In the 'Retention / Revocation of Tax Information Authorization' section, be aware that this document will revoke previous authorizations related to the same tax matters. If you wish to retain any earlier authorizations, check the specified box.

- Finally, in the 'Signature of Taxpayer(s)' section, ensure all parties who need to authorize the form sign it. Include the date and, if applicable, the title of each signer.

- Once all sections are completed and accurately filled out, save the changes, then download, print, or share the completed form as necessary.

Complete your documents online today for efficient tax management.

No, Form 8821 is not a power of attorney. It only allows your representative to receive tax information, without granting them the authority to act on your behalf for decisions or transactions. If you require someone to make decisions concerning your taxes, you will need to utilize Form 2848, which serves as a power of attorney. Choose Form 8821a for simple information access while retaining control over your tax choices.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.