Get Bir Form 2000 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 2000 online

This guide provides a detailed overview of how to complete the Bir Form 2000 online, ensuring that you accurately fill out all necessary sections. Whether you are a first-time user or have some experience, this comprehensive guide aims to support you every step of the way.

Follow the steps to complete the Bir Form 2000 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

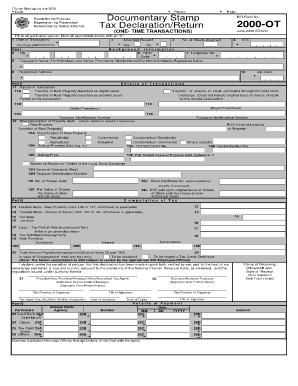

- Fill in the date of transaction in the appropriate field, and indicate whether this is an amended return by marking 'Yes' or 'No'.

- Complete the background information section, providing the Taxpayer Identification Number (TIN), registered name, address, and contact information.

- In Part I, describe the nature of the transaction by selecting the appropriate type, such as transfer of real property or transfer of shares of stock.

- Enter details of the parties involved in the transaction, including their names, TINs, and the relation to the transaction (buyer/seller).

- Provide a brief description of the property sold, including its location, classification, and any Tax Declaration or Certificate of Title numbers.

- Move on to Part III to compute the tax, filling out the taxable base and tax due based on the relevant information provided.

- If applicable, specify any penalties, surcharges, or interest based on the tax computation provided.

- Complete the declaration section at the end of the form by signing and noting the title of the signatory, along with their TIN.

- Finally, save, download, print, or share the completed form as necessary for submission.

Complete your documents online today for a seamless experience.

To file your documentary stamp tax (DST), you'll need to complete the appropriate BIR form and submit it along with the payment at your local BIR office. The filing process may require specific supporting documents, so gathering your receipts and contract agreements in advance is crucial. For additional assistance and resources, US Legal Forms offers a wide range of forms and guides to streamline your DST filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.