Loading

Get Eftps Worksheet 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Eftps Worksheet online

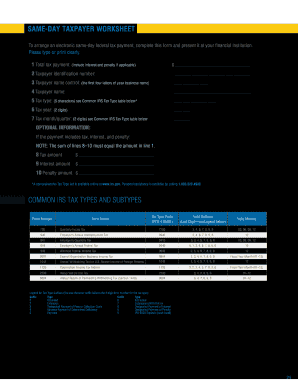

The Eftps Worksheet is essential for arranging an electronic same-day federal tax payment. This guide provides clear, step-by-step instructions on how to effectively complete this form online.

Follow the steps to fill out the Eftps Worksheet online.

- Click ‘Get Form’ button to access the Eftps Worksheet and open it in the online editor.

- Enter the total tax payment in the first field. Include any applicable interest and penalties, and ensure the amount is accurate.

- In the second field, input your taxpayer identification number—this is crucial for processing your payment.

- Next, provide the taxpayer name control by entering the first four letters of your business name.

- Input the full taxpayer name in the designated field to identify your business accurately.

- Select the tax type by entering the appropriate five-character code as per the Common IRS Tax Type table available.

- Indicate the tax year using the last two digits of the relevant calendar year.

- Specify the tax month or quarter with a two-digit entry, referring to the Common IRS Tax Type table for accuracy.

- If your payment includes tax, interest, and penalty, fill in the respective amounts in lines 8, 9, and 10, ensuring the total matches line 1.

- Review all information for accuracy. Once confirmed, you can choose to save changes, download the form, print it, or share it as necessary.

Complete your Eftps Worksheet online today to ensure timely and accurate tax payments.

Worksheet A for taxes typically refers to a document used to claim deductions for specific expenses or adjustments to income, such as itemized deductions. It plays a vital role in accurate tax preparation. Integrating the Eftps Worksheet with Worksheet A can enhance your understanding of tax payments and refunds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.