Loading

Get Payroll Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Form online

This guide is designed to assist users in accurately completing the Payroll Form online. By following the outlined steps, users can ensure that they fulfill their reporting requirements efficiently and effectively.

Follow the steps to complete the Payroll Form with ease:

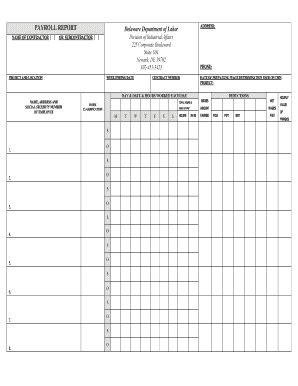

- Press the ‘Get Form’ button to access the Payroll Form and open it in your preferred editing tool.

- Enter the name of the contractor or subcontractor in the designated field.

- Provide the project name and location, ensuring to include the full address.

- Fill in the week ending date for which you are reporting payroll information.

- Include the contact phone number for the contractor or subcontractor.

- Input the contract number associated with the project.

- Indicate the date of the prevailing wage determination utilized for the project.

- Record each employee's name, address, and social security number in the specified sections.

- Identify the work classification for each employee by selecting from the available options.

- Document the hours worked for each day of the week, ensuring accuracy for payroll calculations.

- Enter the hourly rate of pay for each employee.

- Calculate and fill in the gross and net wages for each employee, as well as the total amount.

- List any deductions for FICA, federal withholding tax (FWT), and state withholding tax (SWT).

- Summarize the total hours and wages earned for the payroll period.

- Provide information regarding fringe benefits in accordance with the regulations.

- Complete the statement of certification by the signatory party, ensuring all required details are filled in.

- Finally, sign the form, include the date, and ensure a notary public witnesses the signature.

- Once completed, save your changes and, if necessary, download, print, or share the form as required.

Take a moment to complete your Payroll Form online now, ensuring you meet your reporting obligations.

When you start a new job, ask your HR or payroll department for the direct deposit form. They will provide you with the necessary paperwork to fill out and submit your bank account details securely. Alternatively, resources like US Legal Forms can assist you in finding a suitable direct deposit form template.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.