Get Caap Form 541 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Caap Form 541 online

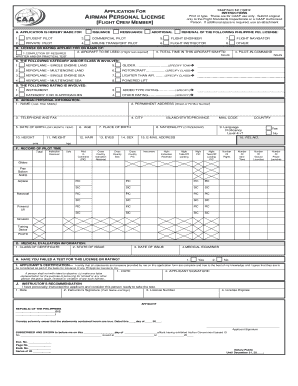

Filling out the Caap Form 541 online is a straightforward process that allows users to apply for an airman personal license as flight crew members. This guide provides clear, step-by-step instructions to help users complete each section of the form accurately.

Follow the steps to effectively complete the online form.

- Click ‘Get Form’ button to access the Caap Form 541 and open it for editing.

- Begin by selecting the appropriate option under section A, indicating if this is an issuance or reissuance request.

- For section B, specify the license or rating applied for and the basis for this application. Fill in any aircraft details required for flight tests.

- In section C, indicate the category and class of the aircraft involved, selecting from the available options such as aeroplane, glider, or rotorcraft.

- Complete section D by indicating any special ratings required, such as instrument ratings or additional type ratings.

- Provide personal information in section E, including full name, address, telephone number, date of birth, and nationality.

- In section F, you will record your flight experience, including total pilot time and solo hours.

- Section G requires medical evaluation information, including the class of certificate and the date of issue.

- Indicate whether you have failed any tests in section H.

- In section I, certify your application with your signature and the date. Ensure your information is truthful.

- Complete sections J through M with the recommendations and records provided by your instructor and any examiners.

- Finally, review all entries for accuracy, then save changes, and use the available options to download, print, or share the completed form.

Start completing your Caap Form 541 online today to ensure a smooth application process.

The form used for fiduciary income tax returns in California is the CA 541, which is specifically designed for trusts and estates. This form allows fiduciaries to report the income, deductions, and credits of the trust or estate. Completing the CA 541 accurately is essential for correct tax reporting and ensuring beneficiaries receive their rightful share. Platforms like US Legal Forms provide helpful resources for filing your CA 541 and navigating any complexities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.