Loading

Get Amount Of Overpayment To Be Applied To 2018 Estimated Tax 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

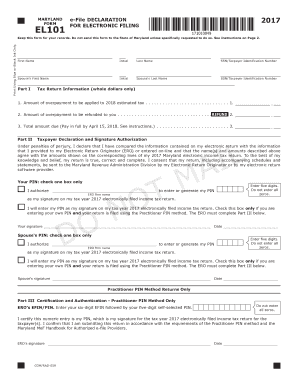

How to fill out the Amount Of Overpayment To Be Applied To 2018 Estimated Tax online

This guide provides a clear and supportive approach to filling out the Amount Of Overpayment To Be Applied To 2018 Estimated Tax form online. By following the steps outlined below, users can easily navigate through each component of the form with confidence.

Follow the steps to successfully complete the form online:

- Use the ‘Get Form’ button to access the form and open it in your preferred online editor.

- In the first section, provide your first name, initial, and last name, along with your Social Security Number or Taxpayer Identification Number.

- If applicable, enter your spouse’s first name, initial, last name, and their Social Security Number or Taxpayer Identification Number.

- In Part I, locate the field labeled ‘Amount of overpayment to be applied to 2018 estimated tax’ and enter the total amount you wish to apply.

- Proceed to fill in the amount of overpayment you desire to be refunded in the next field.

- Complete the ‘Total amount due’ field if applicable, ensuring this is paid by the due date of April 15, 2018.

- In Part II, declare and sign the authorization, confirming the accuracy of the information by entering your Personal Identification Number (PIN). Check the appropriate box to indicate if you authorize the Electronic Return Originator (ERO) to enter the PIN.

- If your spouse is filing, have them enter their PIN as well, and check the necessary box.

- Finally, review all the entered information for accuracy, save your changes, and download or print the completed form for your records.

Complete your documents online today for a streamlined filing process.

Applying your overpayment to next year's taxes can be beneficial if you expect similar income levels. By doing so, you effectively decrease your tax burden for that year. Always consider your current financial situation and consult with a tax professional if you are unsure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.