Get 1244b 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1244b online

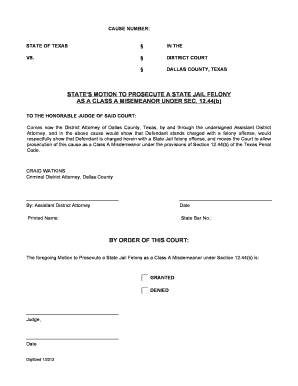

The 1244b form is essential for individuals or legal representatives seeking to prosecute a state jail felony as a class A misdemeanor under Texas law. This guide provides clear and concise instructions to help you successfully complete the form online.

Follow the steps to accurately complete the 1244b form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the cause number at the top of the form. This number is crucial as it helps identify the case associated with the motion.

- In the section titled 'State of Texas,' confirm that the form indicates the correct jurisdiction, which will typically be Dallas County in this context.

- In the body of the form where it mentions 'Comes now the District Attorney,' make sure to input the accurate titles and names as applicable. Leave placeholders for any additional filler information as necessary.

- Fill in the defendant's name and information where indicated. This may require legal identification details associated with the case.

- In the statement where it refers to the motion to request prosecution as a Class A misdemeanor, review and adjust any legal language to reflect current details pertinent to the case.

- The 'By Order of This Court' section will need to be completed by the judge after the form has been submitted. Ensure that there is an area for the judge’s signature and date.

- After completing the form, review all entries for accuracy. Make adjustments if necessary before proceeding.

- Users can save changes, download, print, or share the completed form according to their needs.

Start your document filing online today and ensure your forms are submitted correctly.

In Texas, the five levels of felonies range from capital felonies, which carry the harshest penalties, to state jail felonies, which are the least severe. Capital felonies can result in life sentences or death, while first-degree felonies can lead to 5 to 99 years in prison. Second and third-degree felonies fall in between, typically involving penalties of 2 to 20 years. Understanding these classifications, especially how a 1244b might apply, can empower individuals when facing legal action.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.