Loading

Get Imrf Enrollment Form 610

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Imrf Enrollment Form 610 online

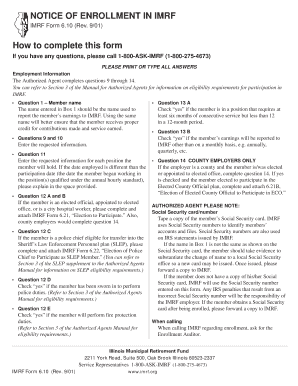

Completing the Imrf Enrollment Form 610 online is essential for individuals seeking to participate in the Illinois Municipal Retirement Fund. This guide provides comprehensive, step-by-step instructions on how to accurately fill out the form to ensure a smooth enrollment process.

Follow the steps to fill out the Imrf Enrollment Form 610 online.

- Use the ‘Get Form’ button to obtain the Imrf Enrollment Form 610 and open it in your preferred online document editor.

- Fill in your personal details in the MEMBER INFORMATION section. This includes your last name, first name, middle initial, and Social Security number. Ensure that the name you provide matches the one on your Social Security card to avoid any issues.

- Continue by providing your mailing address, including city, state, and ZIP code. It is also important to enter your home telephone number for contact purposes.

- Indicate your date of birth, sex, and marital status. Ensure that this information is accurate as it may affect your retirement benefits.

- In the section regarding other public pension systems, select 'Yes' or 'No' depending on your participation in any other Illinois public pension plans. If 'Yes,' check all applicable boxes.

- The EMPLOYMENT INFORMATION section must be completed by your employer. They should enter their name, IMRF I.D. number, and department along with your position title.

- Your employer must also indicate the participation date and employment date. If there is a discrepancy, an explanation should be provided.

- Complete questions regarding your employment status (elected official, city hospital worker, etc.) and whether you perform police or fire protection duties. Additional forms may be required for certain roles.

- Make sure the employer certifies the information by signing and dating the form.

- Finally, review all entered information for accuracy. You can then save changes, download, print, or share the completed form as needed.

Start filling out your Imrf Enrollment Form 610 online today to secure your retirement benefits.

Yes, your employer is required to contribute to your IMRF account on your behalf. These contributions, along with yours, help fund your future retirement benefits. Understanding how these contributions work can enhance your financial planning, and the IMRF Enrollment Form 610 provides insight into this vital aspect.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.