Loading

Get Blank Wv Low Earnings Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Blank Wv Low Earnings Form online

Filling out the Blank Wv Low Earnings Form online can be a straightforward process when you understand each component of the form. This guide will provide step-by-step instructions to help you complete the form effectively.

Follow the steps to complete the Blank Wv Low Earnings Form

- Click ‘Get Form’ button to obtain the form and open it for editing.

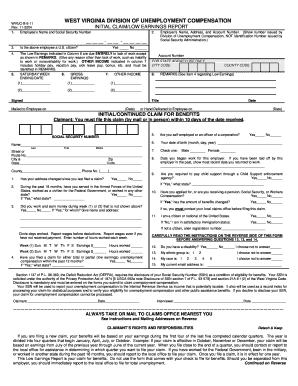

- In the first section, enter the employee's name and social security number accurately to ensure proper identification.

- Fill out the employer's name, address, and account number as issued by the Division of Unemployment Compensation, not the Social Security Administration.

- Indicate whether the employee is a U.S. citizen by selecting 'Yes' or 'No'.

- In Column 6, provide the gross earnings for the weeks indicated and in Column 7, list any other income such as holiday or vacation pay. Remember to include any remarks that clarify sources of income.

- Complete the sections for each week, ensuring you report hours worked and earnings, following the format provided.

- If any additional questions apply – such as address changes, military service, or child support obligations – respond accurately.

- At the end of the form, sign and date it. Review all entered information for accuracy before proceeding.

- Once completed, you can save changes, download the form, print it, or share it as needed.

Complete your documents online for a seamless experience.

Your unemployment benefit amount in West Virginia depends on your previous earnings, but typically, it can be calculated based on a percentage of your highest quarterly wage. By filling out the Blank WV Low Earnings Form, you will provide the necessary details to assess your benefits. Make sure you check the state's guidelines to understand the maximum benefit amounts. This way, you can estimate what to expect.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.