Get Understanding Your Paycheck Worksheet Answer Key

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Understanding Your Paycheck Worksheet Answer Key online

This guide provides step-by-step instructions on how to effectively fill out the Understanding Your Paycheck Worksheet Answer Key online. By following these guidelines, users will gain clarity on payroll systems and enhance their financial literacy.

Follow the steps to complete the worksheet online:

- Click 'Get Form' button to obtain the form and open it in an online editor.

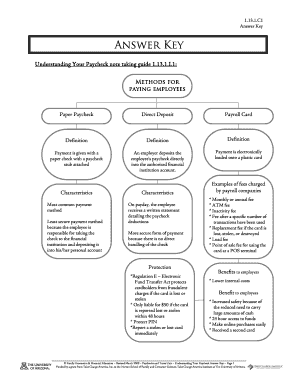

- Begin by reviewing the components of the worksheet. Familiarize yourself with the definitions and characteristics of different payment methods, including paper paycheck, direct deposit, and payroll cards.

- Move on to the section regarding taxes. Understand the compulsory charges imposed by various levels of government and the services funded by these taxes.

- Fill out the employment forms related section. This includes understanding and recording details for Form W-4 and Form I-9, which are essential for tax withholding and employment eligibility.

- Next, concentrate on the paycheck stub information. Input details about gross pay, net pay, deductions, and mandatory taxes, ensuring clarity on how each component affects overall earnings.

- Proceed to required and optional deductions. Understand the implications of each deduction type, such as federal and state withholding tax, FICA, and retirement contributions.

- Complete the remaining fields regarding payment option choices and specify any variations based on individual circumstances.

- Finally, save your changes. You can download, print, or share the completed worksheet as needed.

Start filling out your Understanding Your Paycheck Worksheet Answer Key online today for better financial understanding!

Related links form

The three main parts to view on your paystub include your earnings, deductions, and taxes withheld. Firstly, your earnings show your gross income before any deductions. Next, the deductions section reveals what is taken out, such as health insurance and retirement contributions. Finally, the taxes withheld section indicates how much is deducted for federal and state taxes. For further guidance, the Understanding Your Paycheck Worksheet Answer Key is an excellent resource to navigate these components with ease.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.