Loading

Get Form 3911

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3911 online

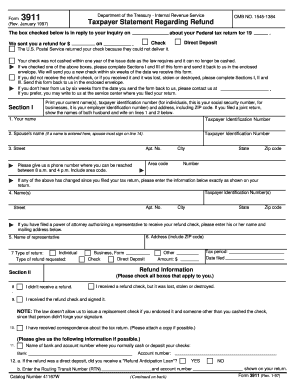

Filling out Form 3911 is an essential step for individuals who need to request a replacement for their tax refund. This guide provides step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to fill out Form 3911 with ease.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In Section I, print your current name, taxpayer identification number (social security number for individuals, employer identification number for businesses), and your address with ZIP code. If you filed a joint return, include both names.

- Enter your phone number where you can be reached between 8 a.m. and 4 p.m. This should include the area code.

- If any information has changed since you filed your tax return, provide the current taxpayer identification number and updated address below Section I.

- In Section II, check all applicable boxes describing your refund status: if the check was lost, stolen, or destroyed, or if you simply did not receive it.

- Provide additional information if possible, including the bank name and account number where you usually cash or deposit your checks.

- Follow with the Section III Certification by signing the form exactly as you signed your tax return. If applicable, include your spouse's signature.

- Review the information for accuracy, then save changes, download, or print the form for your records before sending it in the provided envelope.

Complete your Form 3911 online today to ensure you receive your tax refund replacement promptly.

Claiming a replacement refund check requires completing Form 3911 to notify the IRS about the lost check. In your application, be sure to provide all necessary details regarding your refund. Once you submit the form, the IRS will investigate your claim and process the reissue of your check.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.