Get 2018 Form M 2210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2018 Form M 2210 online

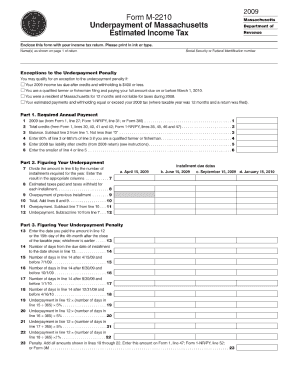

The 2018 Form M 2210 is essential for individuals looking to report their estimated tax payments accurately. This guide provides a comprehensive overview to assist you in filling out the form online, ensuring you can navigate each section with ease.

Follow the steps to complete your form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by entering your personal information, including your name, Social Security number, and address in the fields provided. Ensure that the information is accurate to avoid any processing delays.

- In the next section, report your income details. Fill in the amounts as required based on your income sources, such as wages, business income, or other earnings.

- Proceed to the section for tax computation. Calculate any taxes owed based on your income, and input the figures into the designated fields. This is crucial for determining the correct estimated payment amounts.

- Review your estimated tax payments for the year. Indicate any payments that have already been made, ensuring that totals reflect the correct amounts.

- Once all sections are completed, carefully review the entire form for accuracy and completeness, making any necessary corrections.

- Finally, save changes to your completed form. You can choose to download, print, or share the form as needed.

Start filling out your 2018 Form M 2210 online today to streamline your tax reporting process.

In Massachusetts, you may avoid paying sales tax on a used car by providing specific documentation that qualifies for an exemption. For instance, if the vehicle is a gift or inherited, it may be exempt from sales tax. However, it is essential to check the latest regulations or consult with a tax professional. Resources like US Legal Forms can help guide you through the paperwork and ensure compliance with the necessary requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.