Loading

Get Sts 20003 A Revised 06 2017 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Sts 20003 A Revised 06 2017 online

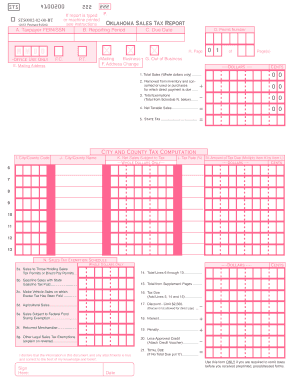

Filling out the Sts 20003 A Revised 06 2017 online can seem daunting, but with clear guidance, you can complete it efficiently. This document assists tax filers in reporting sales tax accurately and fulfilling their responsibilities with ease.

Follow the steps to successfully fill out the Sts 20003 A Revised 06 2017 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Item A, enter your taxpayer identification number, which may be your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

- In Item B, input the reporting period, specifying the month(s) and year for the sales being reported, starting with the month of your first sale.

- Fill in Item C with the due date for your sales tax report.

- Provide your Sales Tax Permit Number in Item D.

- In Item E, enter your name and the mailing address where correspondence should be sent.

- For Item H, indicate the total number of pages you are submitting, as shown in the boxes next to the word 'of.'

- If closing your business, mark the box in Item G and return your permit card with this report.

- In Line 1, total all sales, including both taxable and non-taxable receipts. If there were no sales, leave this blank.

- For Line 2, enter the value of tangible personal property purchased for resale that was consumed in the reporting period.

- On Line 3, use the Exemptions Schedule (Item N) to report any authorized exemptions from your gross receipts.

- Calculate the net taxable sales for Line 4 by subtracting Line 3 from the total of Lines 1 and 2.

- Determine the state tax due for Line 5 by multiplying Line 4 by the applicable tax rate.

- Complete Lines 6 through 13 for City/County Tax Computation by entering taxable sales and tax rates for each.

- In Line 14, total the tax due from Lines 6 through 13.

- Line 15 is where you will enter the total from any supplementary pages.

- Calculate Line 16 for total tax due by adding Lines 5, 14, and 15.

- If eligible, compute the discount on Line 17; leave blank if filing late.

- For Line 18, if filing late, calculate interest based on the amount due.

- In Line 19, compute any penalties applicable for late filing.

- Enter any previous credits on Line 20, attaching necessary vouchers.

- Calculate the final amount due on Line 21 as the total from previous lines, subtracting discounts and credits.

- Sign and date the form, then mail it along with your payment to the Oklahoma Tax Commission.

Complete your Sts 20003 A Revised 06 2017 online and fulfill your tax obligations with confidence.

Claiming sales tax on your taxes requires that you itemize your deductions on your return. Be aware of what documentation you need, including the STS 20003 A Revised 06 2017, to support your claim. Resources like uslegalforms can provide critical assistance in navigating the claiming process effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.