Loading

Get Home Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Home Loan Application online

Filling out a home loan application online can seem daunting, but with the right guidance, it can be a straightforward process. This guide provides a detailed overview of each section of the Home Loan Application, helping you complete it accurately and efficiently.

Follow the steps to complete your home loan application online with confidence.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

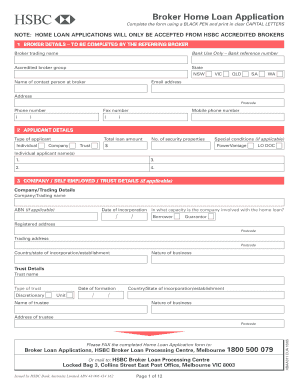

- Begin with the broker details section, which should be filled out by the referring broker. This includes entering the broker's trading name, email address, contact person's name, phone numbers, and the accredited broker group.

- In the applicant details section, indicate the total loan amount you are applying for and select the type of applicant: individual, company, or trust. Enter the number of security properties and any special conditions if applicable.

- Complete the company details section if applicable, providing the company's trading name, ABN, and date of incorporation. Specify the nature of business and include the registered and trading address.

- Review the checklist to ensure that all required supporting documents are attached. This is crucial for ensuring a smooth application process.

- Move on to the funds statement section. Here, record all necessary details related to the funding required, including purchase price, deposit paid, and other relevant costs.

- Specify the loan structure and purpose in the designated section. This includes information on the total loan amount, loan type, loan purpose, and repayment options.

- Fill in the personal and employment details for each applicant, including current occupation, employer details, and whether the applicant is an HSBC customer.

- Complete the statement of assets and liabilities to outline your financial situation, including combined assets and liabilities for joint applicants.

- Review your completed application form carefully, then save your changes, download the form, and print it as needed. Make sure to follow the submission instructions provided to ensure timely processing.

Start your home loan application online today and take the first step towards homeownership.

Bank lenders typically offer better rates and the added security of working with a well-established lender, but loans from private online lenders are often quicker and easier to get. The option that will work best for you depends on your specific circumstances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.