Loading

Get Exchange Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exchange Form online

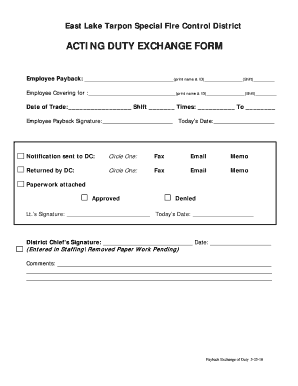

The Exchange Form is a vital document for employees within the East Lake Tarpon Special Fire Control District to facilitate duty exchanges. This guide provides step-by-step instructions on how to complete the form online effectively.

Follow the steps to fill out the Exchange Form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your information as the employee initiating the payback. Input your name and ID in the provided fields, along with the shift you are trading.

- Next, provide the details of the employee you are covering for. Fill in their name and ID, followed by their shift information.

- Indicate the date of the trade in the designated field. Specify the shift and the times that the trade will occur.

- Once you have completed the necessary fields, sign in the Employee Payback Signature section and date it accordingly.

- Select the method by which you will notify the District Chief by circling your choice: Fax, Email, or Memo.

- After the District Chief returns the notification, circle one of the options indicating how it was returned.

- Ensure to have the necessary approvals by obtaining signatures from both the Lieutenant and the District Chief, along with the respective dates.

- Finally, you may add any relevant comments in the comments section. Once all fields are filled, review the form for accuracy.

- You can now save changes, download, print, or share the completed form as needed.

Complete your Exchange Form online today for a seamless duty exchange process.

For a 1031 exchange, you fill out Form 8824 to report the exchange to the IRS. This form includes information about the properties exchanged, the transaction dates, and gain or loss information. Completing Form 8824 accurately is critical to ensuring that you benefit from the tax advantages of your exchange. Consider using resources like USLegalForms to simplify this task.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.