Loading

Get It77c 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It77c online

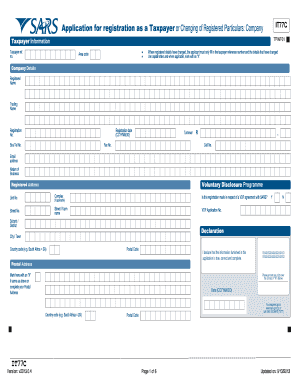

The It77c form is essential for registering as a taxpayer or updating registered particulars for a company. This guide will provide you with comprehensive, step-by-step instructions to successfully fill out the It77c online, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to accurately complete the It77c form online.

- Press the 'Get Form' button to obtain the It77c form and open it in your online editor.

- In the 'Taxpayer Information' section, enter your taxpayer reference number and any changed details using capital letters. Mark any applicable fields with an 'X'.

- In the 'Company Details' section, fill in the registered name, trading name, registration number, and registration date. Provide your business telephone number, fax number, cell number, email address, turnover, and nature of business.

- Indicate if the registration is made under a Voluntary Disclosure Programme agreement with SARS by marking 'Y' for yes or 'N' for no.

- Complete the 'Registered Address' section with details including unit number, street number, street name, suburb, district, city or town, postal code, and country code.

- In the 'Postal Address' section, mark the box if it is the same as the registered address, or complete the relevant fields if it differs.

- Finish with the declaration section by signing over the designated lines, and provide the date.

- If applicable, fill out the 'Public Officer Details' including surname, initials, ID number, date of birth, contact numbers, and email.

- Complete the 'Trading Details' to indicate the company’s trading status and provide the financial year end if applicable.

- For partnerships, fill in the details of the three main partners, including taxpayer reference numbers, surnames, initials, ID numbers, and countries of passport.

- Complete the section for three main directors/shareholders, ensuring to provide all necessary identification and registration details.

- If the company is in liquidation, fill the estate details and provide the meeting dates if relevant.

- Lastly, review the required information under the 'Information Required for Registration / Change of Registered Particulars' to ensure all documents are ready, including proof of the identity of the public officer.

- Once you have filled out all sections, save your changes, and choose to download, print, or share the form as needed.

Start completing your It77c form online today for a smooth registration process.

Filling out your tax details effectively involves gathering all necessary documents before you begin. Make sure you understand each section of the It77c form, and use clear, precise entries. If you find the process overwhelming, consider using uslegalforms for structured guidance that simplifies your overall experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.