Loading

Get Form 14256 Irs 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 14256 Irs online

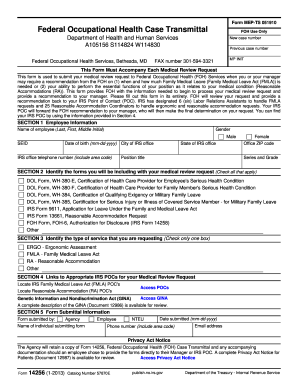

Filling out the Form 14256 Irs online can seem challenging, but with the right guidance, you can complete it accurately and efficiently. This form is essential for submitting a medical review request to Federal Occupational Health Services, ensuring you receive the necessary support for your medical condition or leave.

Follow the steps to complete the Form 14256 Irs online.

- Click ‘Get Form’ button to access the form and open it in a digital format.

- In Section 1, enter the employee information, including the gender, name (last, first, middle initial), SEID, date of birth, city and state of the IRS office, telephone number, position title, office ZIP code, and series and grade.

- In Section 2, check all applicable boxes to identify the forms accompanying your medical review request, such as DOL Form WH-380-E or IRS Form 9611.

- In Section 3, select only one box to indicate the type of service you are requesting, such as Ergonomic Assessment (ERGO), Family Medical Leave Act (FMLA), or Reasonable Accommodation (RA).

- Refer to Section 4 for links to the appropriate IRS Points of Contact (POCs) for your medical review request.

- In Section 5, provide form submittal information by indicating who is submitting the form, entering the individual's name, date submitted, phone number, and email address.

- Once all sections are filled out, review the information for accuracy, then save your changes. You can download, print, or share the form as needed.

Start completing your Form 14256 Irs online today for a seamless submission process.

Related links form

Yes, you can file Form 8862 electronically with the IRS using compatible tax software. This process allows for efficient submission that can speed up your tax return process. If you choose to file electronically, make sure you’re familiar with forms related to your filings, including the essential Form 14256 IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.