Loading

Get Stamp Duty Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Stamp Duty Form online

Filling out the Stamp Duty Form online can streamline the process of paying additional stamp duty. This guide provides clear and comprehensive steps to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Stamp Duty Form online effectively.

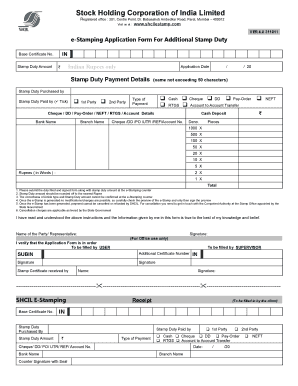

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify and enter the base certificate number clearly in the designated field.

- Input the stamp duty amount in Indian Rupees in the corresponding section.

- Select the application date using the date picker; ensure the correct format is followed.

- Fill in the name of the person purchasing the stamp duty, ensuring it does not exceed 50 characters.

- Indicate who is paying the stamp duty by ticking either the 1st Party or the 2nd Party option.

- Choose the type of payment being made by selecting one of the options: Cash, RTGS, Cheque, DD, Pay-Order, or Account to Account Transfer.

- If applicable, provide the cheque, DD, Pay-Order, or account details, including the bank name and branch name.

- Specify the denominational breakdown of cash on hand, indicating the quantity of each denomination.

- Write the total sum in words, ensuring clarity and accuracy.

- Review all the filled details thoroughly to ensure correctness before submission.

- Once verified, save the changes, download, print, or share the completed form as needed before final submission.

Complete your Stamp Duty Form online today for a seamless experience.

Stamp duty is a tax imposed on the sale of properties or documents in the United States. It applies to several legal documents, particularly in real estate transactions. Understanding the Stamp Duty Form is essential as it helps you determine the necessary payments for your property transactions. By using platforms like USLegalForms, you can easily access and complete your stamp duty forms, ensuring compliance with local laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.