Loading

Get Cotton Fee Exempt 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cotton Fee Exempt online

Filling out the Cotton Fee Exempt form is essential for those who wish to exclude the Cotton Fee from their entry transmissions. This guide provides clear and supportive instructions to help users complete the form online with ease.

Follow the steps to complete the Cotton Fee Exempt form effectively.

- Press the ‘Get Form’ button to access the Cotton Fee Exempt form and open it in your preferred editor.

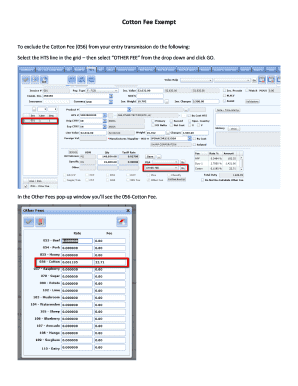

- Select the appropriate HTS line from the grid that pertains to your entry.

- From the dropdown menu, choose 'OTHER FEE' and click 'GO' to proceed.

- In the 'Other Fees' pop-up window, locate the 056-Cotton Fee and enter zero in both the RATE and FEE columns.

- Click the GREEN CHECK to save your changes.

- Return to the main 7501 screen and ensure that the 'Do Not Re-Calculate Other Fee' checkbox is marked.

- Once that is completed, click on the 'CotFee Exempt' button.

- In the CotFee Exempt pop-up, enter the appropriate exemption code ('1' or '2') based on the product's qualification.

- Again, click the GREEN CHECK to save the exemption code.

- Finally, save the HTS line by clicking the SMALL SAVE button.

Take action now and complete your Cotton Fee Exempt form online.

Cotton produced in the United States is assessed at a rate of $1.00 per bale plus a supplemental assessment equal to 5/10 of one percent of the current value of the cotton.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.