Loading

Get Irs Form 1093 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 1093 online

Filling out the Irs Form 1093 online can seem daunting, but with step-by-step guidance, you can easily complete the process. This comprehensive guide will help you navigate each section and field of the form with confidence.

Follow the steps to successfully complete the Irs Form 1093 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

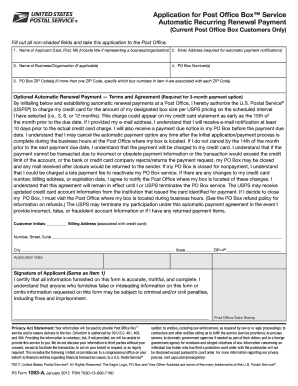

- Carefully enter your name in the designated field, ensuring that you include your last name, first name, and middle initial if applicable. If you are representing a business or organization, also include your title.

- Input your email address, which is required for receiving automatic payment notifications.

- If applicable, provide the name of your business or organization.

- Specify your PO Box number or numbers in the corresponding field.

- Fill in the PO Box ZIP code or codes associated with the box numbers you provided. If you have multiple ZIP codes, clearly indicate which ones correspond to each PO Box.

- Read the optional automatic renewal payment terms and agreement carefully. If you choose to establish automatic renewal payments, initial in the provided space.

- Enter your billing address, associated with the credit card you intend to use for payment, including street number, suite number (if applicable), city, state, and ZIP+4.

- Complete the application date section to indicate when you are submitting the form.

- Sign the application in the designated area to certify that all information provided is accurate, truthful, and complete. Make sure your signature matches the name listed in step 1.

- Once all fields are completed, review the form for accuracy. Save your changes, download, print, or share the form as required.

Complete the Irs Form 1093 online today to ensure your application is processed smoothly.

Yes, the IRS still requires proof of health insurance for tax purposes, even with changes in health care laws. The IRS Form 1093 is a key document that demonstrates compliance with health insurance mandates. By providing relevant information on this form, taxpayers can show they maintain adequate coverage throughout the year. Utilizing US Legal Forms can simplify the process of understanding and filing the IRS Form 1093 accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.