Loading

Get Gstam 1 Format In Excel 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gstam 1 format in Excel online

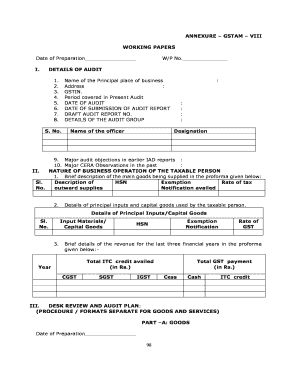

Filling out the Gstam 1 format in Excel online can streamline the audit process and ensure accurate reporting. This guide will walk you through each component of the form, providing clear instructions for effective completion.

Follow the steps to accurately fill out the Gstam 1 format in Excel online:

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully review the date of preparation section and fill in the current date to document when the audit is being conducted.

- Complete the W/P Number field with the unique identifier for your working papers.

- In the Details of Audit section, fill out the necessary information including the name of the principal place of business, address, GSTIN, the period covered in the audit, the date of audit, and the date of submission of the audit report.

- Provide the draft audit report number and complete the details of the audit group; ensure each officer's name and designation are accurately entered.

- List any major audit objections from previous audit reports and any significant CERA observations.

- For the Nature of Business Operation, fill in a brief description of the main goods supplied, including HSN codes and applicable exemption notifications.

- Document the details of principal inputs and capital goods used, including their corresponding HSN codes and rates of GST.

- Outline the financial information for the last three financial years, mentioning ITC credits and total GST payments in the provided format.

- Once all sections are completed, save your changes. You have the options to download, print, or share the filled form as required.

Ensure you complete and submit your Gstam 1 format online to maintain compliance and accuracy.

To implement a GST formula in Excel, you first need to clearly identify the taxable value and the GST rate. Use the formula =Taxable_Value (GST_Rate/100) to calculate the GST amount. This method not only simplifies the process but also strengthens your financial documentation using the Gstam 1 Format In Excel.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.