Loading

Get Simple Interest Worksheet 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Simple Interest Worksheet online

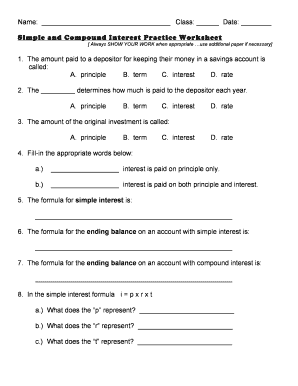

The Simple Interest Worksheet is an essential tool for calculating interest accrued on deposits over time. This guide will provide you with clear, step-by-step instructions on how to complete the worksheet effectively and accurately.

Follow the steps to fill out the Simple Interest Worksheet online.

- Click the ‘Get Form’ button to obtain the Simple Interest Worksheet and open it in your browser.

- Begin by entering your name in the designated section at the top of the form.

- Fill in the class and date fields with the appropriate information.

- Proceed to question one, and select the correct answer from the options provided about the amount paid to a depositor.

- Continue to question two, where you will identify what determines how much is paid to the depositor each year.

- For question three, choose the answer that corresponds with the original investment amount.

- Respond to question four by filling in the blanks regarding interest types.

- In question five, write out the formula for simple interest.

- For questions six and seven, provide the formulas for the ending balance on accounts with simple and compound interest respectively.

- Answer the questions in section eight by identifying what 'p', 'r', and 't' represent in the simple interest formula.

- Complete questions nine and ten, calculating the ending balances using the scenarios provided.

- For questions eleven and twelve, calculate the interest earned based on the principles and rates given.

- Finally, in question thirteen, describe how interest accumulation differs in simple versus compound interest accounts.

- Once all sections are filled out, review your answers for accuracy, then save your changes. You may also download, print, or share the worksheet as needed.

Complete the Simple Interest Worksheet online for accurate interest calculations.

To find the simple interest of $1500 for a period of 4 months at a specific interest rate, first convert 4 months to years which equals about 0.33. Then apply the interest rate in the formula: Interest = Principal x Rate x Time. Our Simple Interest Worksheet can help you explore different rates and see your potential earnings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.