Loading

Get It38 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It38 Form online

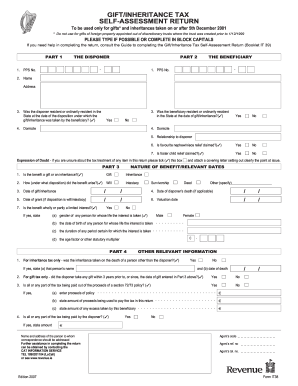

Filling out the It38 Form online is an essential step for individuals handling gifts and inheritances to ensure compliance with relevant tax regulations. This guide will provide you with a clear overview of the form and step-by-step instructions for successfully completing it.

Follow the steps to complete the It38 Form online.

- Press the ‘Get Form’ button to retrieve the It38 Form and open it in the designated editor.

- Complete Part 1, 'The Disponer,' by filling in the Personal Public Service (PPS) Number, name, and address of the disponer.

- In Part 2, provide the name and address of the beneficiary. Answer the questions regarding residency status and any relief claims by selecting 'Yes' or 'No' as applicable.

- Proceed to Part 3 and indicate whether the benefit you received is a gift or an inheritance. Provide details such as the date of gift/inheritance and how the benefit arose (will, intestacy, etc.).

- In Part 4, answer questions related to inheritance tax and any previous gifts taken within a certain timeframe. Provide information about any tax being paid out of policy proceeds if applicable.

- Move to Part 5 and detail the market values of the benefit by categorizing properties under agricultural, business, or other categories based on the relevant criteria.

- Next, in Part 6, outline any liabilities, costs, or expenses that are associated with the benefit and their respective values.

- Complete Part 7 by calculating the taxable value of the benefit, including applicable reliefs and exemptions.

- In Part 8, perform a self-assessment of the capital acquisitions tax payable based on the calculations from previous parts.

- Finally, review all sections for accuracy, ensuring you've signed the declaration in Part 9. You can then choose to save changes, download, print, or share the completed form.

Complete your It38 Form online today to ensure timely compliance with gift and inheritance tax obligations.

A FIRPTA certificate is needed to validate the closing of a property sale involving foreign sellers. It provides assurance that all taxes owed are satisfied, preventing future legal complications. Understanding how to obtain and file this certificate alongside the It38 Form is crucial in the transaction process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.