Loading

Get Form Gst Reg 30 In Excel 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Gst Reg 30 In Excel online

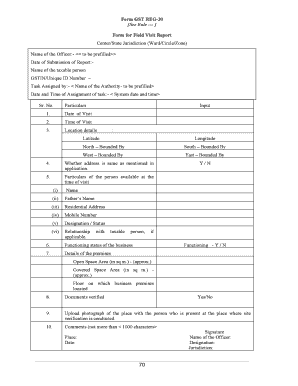

Filling out the Form Gst Reg 30 In Excel is essential for documenting field visit reports related to Goods and Services Tax. This guide will provide straightforward instructions to assist users in completing the form accurately online.

Follow the steps to complete the Form Gst Reg 30 In Excel effectively.

- Click the ‘Get Form’ button to obtain the form and access it in your chosen Excel tool.

- Begin by entering the date of submission of the report in the designated field labeled 'Date of Submission of Report'.

- Input the name of the taxable person and their GSTIN/Unique ID Number in the provided fields.

- In the section labeled 'Task Assigned by', the name of the authority will be prefilled. Verify it for accuracy.

- The 'Date and Time of Assignment of Task' will auto-fill with the system's current date and time.

- Record the date and time of the visit in the respective 'Date of Visit' and 'Time of Visit' fields.

- Enter the location details, including latitude and longitude, along with boundaries for North, South, West, and East.

- Indicate whether the address is the same as mentioned in the application by selecting 'Yes' or 'No'.

- Provide particulars of the person available at the time of visit, including name, father's name, residential address, mobile number, designation/status, and their relationship with the taxable person.

- State the functioning status of the business with a 'Yes' or 'No' and include the approximate open and covered space areas in square meters.

- Indicate whether the required documents were verified with a simple 'Yes' or 'No'.

- Upload a photograph of the place along with the person who was present during the site verification.

- Finally, provide any additional comments, adhering to the character limit of 1000 characters, and include the signature, name of the officer, designation, jurisdiction, place, and date at the bottom.

- After completing all sections, save your changes, and download, print, or share the completed form as necessary.

Start completing your Form Gst Reg 30 online today for a smooth filing process.

Setting up GST in Excel involves creating a template that captures all necessary data, such as sales, purchases, and GST calculations. You can use the Form Gst Reg 30 In Excel to track these figures accurately. This setup not only helps in complying with tax regulations but also makes it easy to generate reports when required.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.