Loading

Get W4 Indiana

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4 Indiana online

Completing the W4 Indiana form is an essential step in ensuring accurate tax withholding based on your specific circumstances. This guide will walk you through each component of the form, providing straightforward instructions to assist you in filling it out online with confidence.

Follow the steps to accurately complete your W4 Indiana form.

- Press the ‘Get Form’ button to obtain the W4 Indiana form and open it for editing in your preferred format.

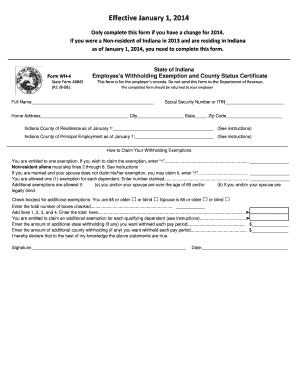

- Enter your full name, Social Security number or ITIN, and home address in the designated fields. Make sure to fill in your Indiana county of residence as of January 1 and your county of principal employment on the specified lines.

- In line 1, if you wish to claim an exemption for yourself, enter '1'. Nonresident aliens should skip to line 7.

- If you are married and your partner does not claim their exemption, you may claim it by entering '1' on line 2.

- For each dependent, put the number claimed on line 3. Ensure each dependent meets the qualifying criteria as per Indiana tax guidelines.

- If you or your spouse are over the age of 65 or legally blind, check the appropriate boxes for additional exemptions on line 4.

- Add the total number of exemptions from lines 1, 2, 3, and 4. Record this total in the box provided.

- If you wish to request additional withholding, indicate the amount on the respective lines for state and county withholding. Remember, this action does not mandate your employer to comply with the request.

- Review all the information for accuracy. Once satisfied, affirm the declarations by signing the form and noting the date.

- Save your changes and download or print the completed W4 Indiana form to return to your employer.

Ensure your tax withholding is accurate by completing your W4 Indiana form online today.

When determining your filing status for the W4 Indiana, consider whether you are single, married, or head of household. Each category has distinct tax benefits and implications that influence your withholding amount. Accurately filling this section ensures proper tax deductions from your paycheck. If you need further assistance, consult USLegalForms for comprehensive guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.