Get Exemption Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exemption Certificate online

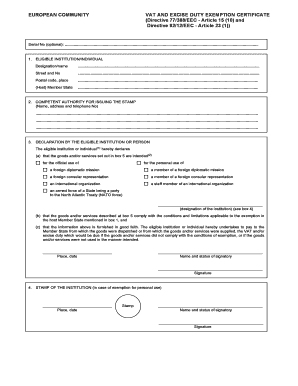

Filling out the Exemption Certificate online is an essential process for eligible individuals and institutions seeking VAT and excise duty exemptions. This guide provides user-friendly, step-by-step instructions to ensure a smooth completion of the form.

Follow the steps to correctly fill out the Exemption Certificate online.

- Click ‘Get Form’ button to obtain the Exemption Certificate and access the form in your chosen document editor.

- In the first section, provide the designation or name of the eligible institution or individual. Include the street address, postal code, and location in the designated fields.

- Fill in the details of the competent authority for issuing the stamp, including the name, address, and telephone number related to the authority.

- In the declaration section, indicate the intended use of the goods and/or services by selecting the appropriate box for either official or personal use. Ensure to affirm that the details provided are accurate and that you will comply with tax regulations.

- Provide a detailed description of the goods and/or services for which the exemption is requested. This includes information about the supplier, the quantity, total value, and other related data.

- After filling in the details, the competent authority will need to certify the exemption by stamping the form and signing it as indicated in the certification section.

- If applicable, include any permission to dispense with the stamp if this exemption is for official use, ensuring all required details are accurately filled in.

- Before completion, verify all entries for accuracy and completeness. Save changes upon finalization, and you may choose to download, print, or share the filled form as per your needs.

Start filling out your Exemption Certificate online today to ensure compliance and benefit from applicable tax exemptions.

The certificate of eligibility for tax exemption confirms that an individual or organization meets the necessary requirements to qualify for tax exemptions. This certificate grants you legal recognition and protection under tax laws, ensuring that you are not subject to certain tax liabilities. Ensuring you have such a certificate can save significant amounts during tax assessments. With uslegalforms, you can navigate this process efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.