Get Form 1001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1001 online

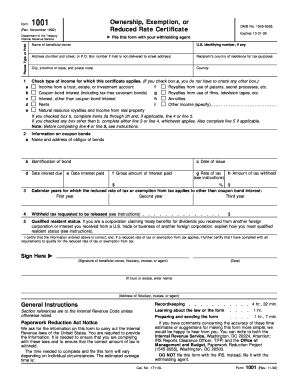

Filling out Form 1001 accurately is essential for beneficial owners of certain types of income. This guide provides a clear, step-by-step approach to completing the form online, ensuring you meet all requirements efficiently.

Follow the steps to complete Form 1001 online.

- Use the 'Get Form' button to access the form and initiate it in your online editor.

- Enter the name of the beneficial owner in the designated field, ensuring it is legible and correctly spelled.

- Input the U.S. identifying number, if applicable, in the provided space. This number may be required for tax identification purposes.

- Fill in your address, including the number and street or P.O. Box if necessary. Ensure this reflects your official residence.

- Indicate your country of residence for tax purposes by selecting it from the dropdown menu or typing it in if not listed.

- Select the type of income for which the certificate applies by checking the appropriate box, ensuring you only check one when selecting box a.

- If applicable, complete items 2a through 2h regarding coupon bond information, including the name and address of the obligor and amount of tax withheld.

- Fill out line 3 indicating the calendar years for which a reduced rate or exemption applies, ensuring accuracy in years listed.

- Complete line 4 to request a release of withheld tax if necessary, identifying the income tax treaty and the rate of tax next to your entry.

- If claiming qualified resident status, provide details on line 5, explaining how your corporation meets the criteria outlined.

- Certify the accuracy of the information provided by signing the form as the beneficial owner or authorized agent, and date the document.

- Finally, save your changes, and download, print, or share the completed Form 1001 as needed.

Complete your Form 1001 online today to ensure compliance with tax regulations.

To obtain a 1098-T form, you typically need to contact your educational institution directly, as they are required to provide this form to eligible students. The form details tuition payments, making it essential for tax filing. If you're unsure about the process or need assistance, our platform offers helpful guidance and tools to make retrieving your 1098-T form straightforward and efficient. Stay informed and maximize your educational tax benefits by ensuring you have this important document.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.