Loading

Get Form 603 Vat

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 603 Vat online

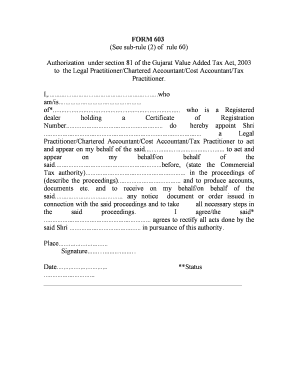

Form 603 Vat is a crucial document for appointing legal practitioners or tax professionals to act on behalf of registered dealers under the Gujarat Value Added Tax Act, 2003. This guide provides comprehensive, step-by-step instructions on how to complete this form accurately online, ensuring a smooth filing process.

Follow the steps to fill out the Form 603 Vat online effectively.

- Press the ‘Get Form’ button to access and open the Form 603 Vat for completion.

- Begin filling in your name in the designated space where it states 'I,.................................................................who am/is..................................................'. Ensure your name is exactly as it appears on the Certificate of Registration.

- In the next section, input the full name of the registered dealer by utilizing the line provided: 'of*...........................................................................'. This should match the details on the registration certificate.

- Enter your Certificate of Registration Number in the space labeled 'holding a Certificate of Registration Number.........................................................'. Make sure this number is accurate to avoid confusion.

- Specify the name of the appointed representative in the segment starting with 'do hereby appoint Shri .............................................................................................'. Ensure that the individual being appointed fits the role of a legal practitioner, chartered accountant, cost accountant, or tax practitioner.

- Indicate the specific Commercial Tax authority in the section that asks you to 'state the Commercial Tax authority'........................................................... where proceedings will take place.

- Describe the nature of the proceedings in the field labeled '(describe the proceedings).....................................'. Include key details related to your tax affairs.

- Clarify what documents or accounts the representative is authorized to present during the proceedings by stating 'to produce accounts, documents etc.'. Be concise yet comprehensive.

- Sign and date the form at the bottom in the sections labeled 'Signature' and 'Date'. Also, ensure to provide your current status like proprietor, partner, director, etc., in the designated space.

- The authorized representative should also complete the acceptance part of the form, stating their qualification and confirming their acceptance of the appointment by signing and dating the respective sections.

- Once you have reviewed the completed form for accuracy, you can save changes, download, print, or share the Form 603 Vat as needed.

Take the next step and complete your Form 603 Vat online for a seamless filing experience.

The 1040EZ form is designed to be simple, especially for taxpayers with straightforward financial situations. Many find it easier to complete than more complicated forms. However, if you encounter difficulties, resources like Form 603 Vat on US Legal Forms can provide helpful instructions and ensure a smooth filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.