Loading

Get Il Bca 14.05 Foreign Corporation 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL BCA 14.05 Foreign Corporation online

This guide provides a clear and straightforward approach to completing the IL BCA 14.05 Foreign Corporation online. With step-by-step instructions, this resource is designed to assist users of all backgrounds in accurately filling out the required information.

Follow the steps to complete your online form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

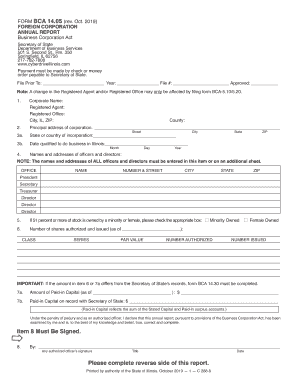

- Begin by entering the corporate name, registered agent details, and the registered office address, including the city, state, and ZIP code.

- Specify the county where the corporation is registered.

- Provide the principal address of the corporation, ensuring that the street address is clear and complete.

- Indicate the state or country of incorporation in the designated field.

- List the names and addresses of all officers and directors. Ensure to include every individual, either in this section or on an additional sheet, as required.

- Enter the date when the corporation was qualified to do business in Illinois, including month, day, year, and associated location details.

- If applicable, check the box indicating if 51 percent or more of the stock is owned by a minority or female. Fill in the number of authorized and issued shares within the specified sections.

- Provide the amount of paid-in capital, the date it corresponds to, and confirm the amount on record with the Secretary of State.

- Sign the form in the designated area, including the date and title of the authorized person.

- Complete either item 9 or 10 based on your situation, ensuring to fill in the respective financial details for the 12-month period specified.

- Calculate the annual franchise tax and fees by following the instructions in item 11, ensuring to account for any interest and penalties if applicable.

- Once all sections are complete, you can save changes, download, print, or share the form as needed.

Complete your IL BCA 14.05 Foreign Corporation online to ensure timely compliance with your reporting obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, a foreign corporation must file a U.S. tax return if it has U.S.-source income or engages in trade within the U.S. This obligation is addressed under the IL BCA 14.05 Foreign Corporation guidelines, which outline the necessary steps for compliance. Filing ensures that foreign entities fulfill their tax responsibilities properly and avoid issues with the IRS.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.