Get Tx Fannie Mae/freddie Mac Form 3244.1 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Fannie Mae/Freddie Mac Form 3244.1 online

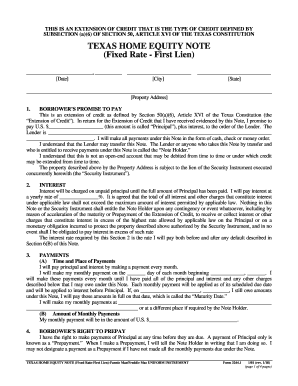

Filling out the TX Fannie Mae/Freddie Mac Form 3244.1 is an essential step in securing your home equity loan. This guide provides clear, step-by-step instructions to help you navigate the form easily and accurately.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the date and city at the top of the form. Ensure that you enter the correct day, month, and year, as this information is critical for record purposes.

- Fill in the 'Property Address' section with the complete address of the property associated with the loan. Double-check for accuracy.

- In the 'Borrower's Promise to Pay' section, write the principal amount you wish to borrow in U.S. dollars. This is the total amount for which you are responsible.

- Specify the lender's name in the provided field. This information should be clear and precise to ensure the lender's records are accurate.

- Record the yearly interest rate you will be paying for the principal amount in the designated section. Make sure this rate adheres to applicable laws regarding maximum interest rates.

- Indicate the monthly payment date that you will adhere to throughout the loan's duration. Make sure the day of the month is consistent each month.

- Detail the amount of your expected monthly payment in U.S. dollars. This amount will be based on your principal and interest rate adjustments.

- Complete the 'Borrower's Right to Prepay' section, where you can outline your right to prepay the loan without incurring penalties. Indicate how and when you will notify the lender of such prepayments.

- For the 'Loan Charges' section, acknowledge any charges that could apply in connection with your loan. Ensure these comply with legal limits.

- Review all entries for accuracy before the finalization. Once confirmed, save your changes, download the document for your records, print it if necessary, or share as required.

Start completing the TX Fannie Mae/Freddie Mac Form 3244.1 online to secure your home equity loan today.

Yes, FNMA (Fannie Mae) does require verification of rent as part of its lending criteria, particularly when using forms like the TX Fannie Mae/Freddie Mac Form 3244.1. This verification ensures that borrowers can maintain their rental obligations before taking on a mortgage. By gathering this information, lenders can better assess the financial readiness of potential borrowers. Uslegalforms provides easy access to the necessary forms and guidance to navigate this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.