Get Canada Rc7191-on E 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC7191-ON E online

This guide provides clear and detailed instructions on how to effectively complete the Canada RC7191-ON E form online. By following these steps, users can ensure that they provide all necessary information to apply for the Ontario new housing rebate.

Follow the steps to fill out the Canada RC7191-ON E form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred online tool.

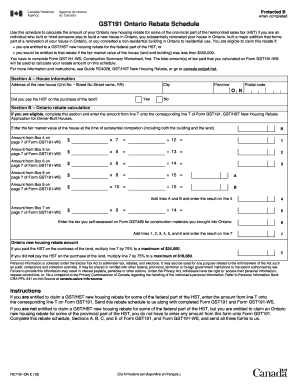

- In Section A, provide the address of the new house, including unit number, street number, street name, city, province, and postal code. Additionally, indicate whether you paid the HST on the purchase of the land by selecting 'Yes' or 'No'.

- Proceed to Section B where you will calculate the Ontario rebate amount. Enter the fair market value of the house at the time of substantial completion, excluding the land, in the designated field.

- For each relevant box from Form GST191-WS (boxes 4 to 9), perform the calculations as outlined in the schedule. Multiply the amounts by the specified rate, and divide by the appropriate number to derive intermediate values.

- Sum all calculated values from Section B to find your total rebate amount. Note if applicable multipliers based on whether HST was paid on land purchase for final calculations.

- Review all fields for accuracy and completeness. Once you have verified that all information is correct, save your changes.

- You may download, print, or share the completed form as necessary. Ensure that forms GST191 and GST191-WS accompany your submission.

Complete your documents online to take advantage of the available housing rebates.

In Canada, electronic payment methods include various options such as debit and credit card transactions, online banking, e-transfers, and mobile wallet services. These methods provide secure and quick ways to manage payments for goods and services. When it comes to payments related to home purchases, understanding how Canada RC7191-ON E fits into your electronic payment strategy can help streamline your financial processes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.