Loading

Get Rrb Form Ba-6 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RRB Form BA-6 online

This guide provides a comprehensive overview of how to effectively complete the RRB Form BA-6 online. By following the outlined steps, users can ensure that they accurately report their railroad service and compensation information.

Follow the steps to successfully complete the RRB Form BA-6 online.

- Click the ‘Get Form’ button to access the RRB Form BA-6 and open it in your online editor of choice.

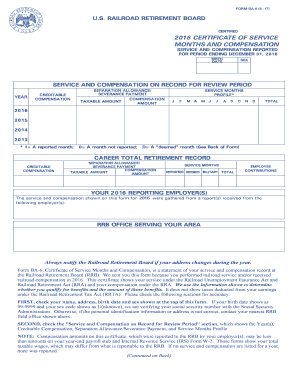

- Review the personal information at the top of the form, including your name, address, birth date, and sex. If you notice any inaccuracies, contact your nearest RRB field office.

- Examine the 'Service and Compensation on Record for Review Period' section. This area details the year, creditable compensation, separation allowance/severance payment, and your service months profile. Ensure that all amounts are correct.

- Check the 'Career Total Retirement Record' section for your lifetime service and compensation records. Pay particular attention to the employee contributions amount and any military service months reported.

- Verify the 'Your 2016 Reporting Employer(s)' section to ensure that it lists the employers who reported your service and compensation accurately.

- If discrepancies are found, consider filing a protest with the RRB by completing Form G-70. Ensure to include all required information, such as your social security number and a clear description of the error.

- After reviewing all sections of the form, save your changes. You may also download, print, or share the completed form as needed.

Start filling out your RRB Form BA-6 online now to ensure your service records are accurate.

Yes, you can lose your railroad retirement benefits if you do not meet specific eligibility criteria set by the Railroad Retirement Board. Situations like failing to comply with earning limits or not maintaining proper documentation can impact your benefits. Regularly submitting the RRB Form BA-6 keeps your records up to date and supports your long-term retirement goals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.