Loading

Get Uk Hmrc Sa109 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC SA109 online

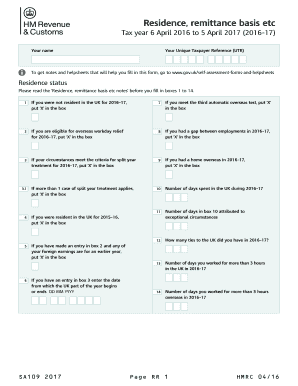

Filling out the UK HMRC SA109 form can seem complex, but this guide aims to simplify the process for you. This document is essential for those with specific residence and remittance circumstances for the tax year, providing the necessary steps to accurately complete it online.

Follow the steps to complete the UK HMRC SA109 online.

- Press the ‘Get Form’ button to obtain the form and open it in the corresponding editor.

- Enter your name in the designated field. This helps identify your submission.

- Input your Unique Taxpayer Reference (UTR), ensuring accuracy to avoid any delays in processing.

- Review the box for residence status. Depending on your circumstances for the tax year 2016–17, mark an appropriate box (1-14) as per the instructions provided in the form notes.

- If applicable, provide details on personal allowances in boxes 15-17. Ensure you are claiming them correctly based on your residency status.

- Complete sections on residence in other countries and the necessary codes for your nationality and residency status by filling in boxes 18-20.

- For domicile relevance regarding your tax liability, check the box if applicable and provide necessary dates in boxes 23-27.

- If you are making a remittance basis claim, place an ‘X’ in box 28 and proceed as instructed, including relevant amounts in boxes 29-39.

- If you have any additional information that needs to be reported, utilize box 40 to detail this.

- After completing all sections, review the form for accuracy. You can then save any changes, download, print, or share the completed form.

Complete your HMRC SA109 form online today for a smoother tax submission experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When leaving the UK, it is essential to inform HMRC of your departure to ensure you comply with tax regulations. Complete the UK HMRC SA109 form as part of your tax return, and consider notifying your bank and utility providers. This step helps to manage your tax matters effectively after you leave.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.