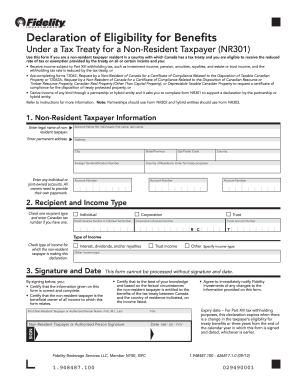

Get Canada Fidelity Nr301 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Canada Fidelity NR301 online

How to fill out and sign Canada Fidelity NR301 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Selecting a certified expert, scheduling an appointment, and attending the office for a confidential discussion renders completing a Canada Fidelity NR301 from beginning to end exhausting.

US Legal Forms enables you to swiftly create legally enforceable documents based on pre-designed online templates.

Quickly generate a Canada Fidelity NR301 without needing to engage professionals. Over 3 million clients are already enjoying our extensive library of legal templates. Join us today and access the top collection of web-based forms. Experience it for yourself!

- Obtain the Canada Fidelity NR301 you need.

- Access it with a cloud-based editor and begin modifying.

- Complete the blank fields; names of the involved parties, addresses, and numbers, etc.

- Personalize the template with specific fillable sections.

- Add the date/time and place your electronic signature.

- Press Done after reviewing everything.

- Download the finalized documents to your device or print them as a hard copy.

How to modify Get Canada Fidelity NR301 2012: personalize forms online

Locate the appropriate Get Canada Fidelity NR301 2012 format and adjust it instantly. Simplify your documentation with an intelligent form-editing tool for digital forms.

Your daily routine with documentation and forms can be more productive when you have everything you require in one location. For instance, you can discover, obtain, and alter Get Canada Fidelity NR301 2012 in a single browser tab. If you need a specific Get Canada Fidelity NR301 2012, it is easy to locate it with the assistance of the smart search engine and access it right away. You do not need to download it or search for an external editor to alter it and input your information. All the tools for effective work are combined in a single comprehensive solution.

This editing tool allows you to customize, complete, and sign your Get Canada Fidelity NR301 2012 form directly on the spot. After you find a suitable template, click on it to enter the editing mode. Once you open the document in the editor, you have all the necessary functions at your disposal. It is simple to complete the specified fields and delete them if needed with the assistance of a straightforward yet multifunctional toolbar. Apply all modifications immediately, and sign the document without leaving the tab by simply clicking the signature field. Afterward, you can send or print your document if required.

Make additional custom edits with available features.

Uncover new opportunities in streamlined and effortless documentation. Find the Get Canada Fidelity NR301 2012 you require in minutes and complete it in the same tab. Eliminate the clutter in your paperwork once and for all with the aid of online forms.

- Annotate your document using the Sticky note feature by placing a note at any location within the file.

- Incorporate essential visual elements if needed, with the Circle, Check, or Cross functions.

- Alter or insert text anywhere in the document using Texts and Text box functions. Insert content with the Initials or Date feature.

- Change the template text using the Highlight and Blackout, or Erase functions.

- Add custom visual elements using the Arrow and Line, or Draw tools.

Filling out the W-8BEN form as a Canadian involves providing your name, address, and TIN, along with declaration of your residency status. Make sure to refer to the specific articles of the Canada-US tax treaty to maximize benefits. If you need assistance, the USLegalForms platform can provide tools and resources to help you throughout the process related to Canada Fidelity NR301.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.