Loading

Get Ie Form Cg1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form CG1 online

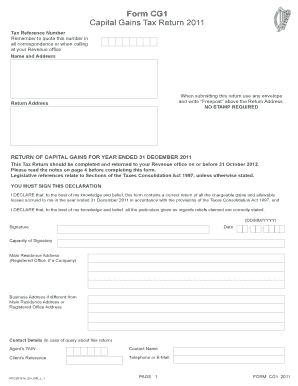

This guide provides a clear and supportive approach to filling out the IE Form CG1 online. It details each component of the form, ensuring that users can navigate the process with ease and confidence.

Follow the steps to complete your IE Form CG1 efficiently.

- Press the ‘Get Form’ button to access the form online and open it for editing.

- Enter your Tax Reference Number in the designated field. This number is crucial for all communications related to your return.

- Fill in your name and address accurately to ensure your return is processed correctly.

- Locate the section titled 'Return of Capital Gains for Year Ended 31 December 2011'. Make sure you read the notes provided to understand what information is required.

- Complete the various fields detailing the disposals of assets, such as the description of assets, number of disposals, and aggregate consideration. Be meticulous to avoid errors.

- Indicate if any disposals occurred between connected parties or at arm's length by checking the appropriate boxes.

- Fill in claims to reliefs according to your situation, ensuring to specify any disposals related to a principal private residence or retirement relief.

- Continue to the next sections to indicate any chargeable gains, previous gains rolled-over, or net losses for 2011.

- Finalise the form by signing and dating your declaration, ensuring that the capacity of the signatory is clear.

- Review all completed information for accuracy, then save your changes, download, print, or share the completed form as necessary.

Complete your IE Form CG1 online today to ensure compliance with tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

For entry of capital gains on your CRA, you will typically reference the information gathered in the IE Form CG1. This form contains all the important data regarding your capital transactions. When preparing your submission, ensure you input the correct figures in the designated areas to avoid issues. If you are unsure, US Legal Forms can aid you in navigating this reporting process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.