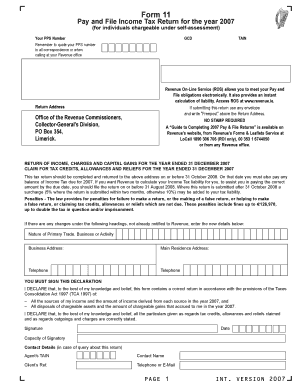

Get Ie Form 11 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form 11 online

Filling out the IE Form 11 online is an essential step for individuals filing their income tax return for the year 2007. This guide provides detailed instructions on completing each section of the form accurately and efficiently.

Follow the steps to complete your IE Form 11 online.

- Press the ‘Get Form’ button to access the IE Form 11. This action allows you to open the form in your digital editor for completion.

- Input your Personal Public Service (PPS) number as required in the personal information section. This number is essential for identifying your tax records.

- Complete Section A by indicating your marital status, number of dependent children, and any changes in personal circumstances during the year 2007.

- Move to Section B and provide details regarding your income from trades, professions, or vocations. Ensure to include the net profits and any relevant capital allowances.

- If you have income from Irish rental properties, fill out Section C with the necessary rental income and expenses incurred.

- Document your income from employment in Section D, including any allowances or deductions applicable for the year.

- In Section E, provide information on any foreign income, ensuring to include any foreign taxes paid that may qualify for credits.

- Complete Sections F, G, and H regarding any additional income sources, exempt income, and annual payments if applicable.

- Carefully review all provided information and sign the declaration in the designated area, confirming that the details are correct.

- Before finalizing your submission, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your IE Form 11 online today to ensure timely compliance with your income tax obligations.

Get form

The IE Form 11K applies to certain individuals with additional filing requirements, particularly those involved with Irish-resident trusts. If you fall under specific guidelines set by the Revenue Commissioners, filing Form 11K becomes necessary to report income from trusts. This ensures comprehensive tax compliance and proper management of tax liabilities. Engaging with resources, like uslegalforms, can simplify the process of understanding and filing the necessary tax forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.