Get Sbli Life Insurance Application 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBLI Life Insurance Application online

Filling out the SBLI Life Insurance Application online is a straightforward process that ensures your information is accurately captured to secure coverage. This guide will provide you with detailed, step-by-step instructions to successfully complete the application.

Follow the steps to complete the online application effortlessly.

- Click the ‘Get Form’ button to obtain the application and open it for editing.

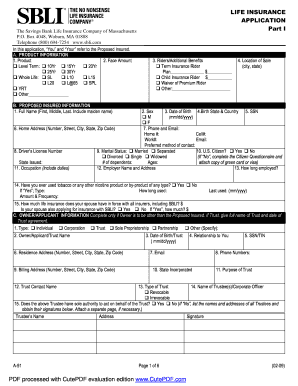

- Begin with the product information section. Select the type of insurance product you desire and specify the face amount. Choose from the options such as Level Term or Whole Life, and indicate any riders or additional benefits you would like to include.

- Provide the proposed insured information by filling in details like full name, sex, date of birth, and Social Security number. Ensure the accuracy of the home address and contact details.

- Fill out the Owner/Applicant Information section if the owner differs from the proposed insured. Specify the type of ownership (Individual, Corporation, Trust, etc.) before providing the respective name and contact details.

- Input beneficiary information clearly. Include primary and contingent beneficiaries, ensuring the total percentages equal 100%. Attach a separate sheet if more space is needed.

- Complete the proposed insured's insurance needs section. Choose between Personal and Business needs and provide necessary figures like gross annual income and liabilities where applicable.

- Answer personal history and health-related questions in detail. If any 'yes' responses apply, provide explanations in the remarks section.

- Fill in the premium payment information, selecting the payment method and frequency, then provide the initial payment amount if required.

- Review the entire application thoroughly. Ensure all provided information is accurate and complete. Save your progress frequently.

- Upon completion, save the changes, download, print, or share the form as needed to finalize your application.

Start filling out your SBLI Life Insurance Application online today to ensure your protection.

To fill out a life insurance claim, start by obtaining the claim form from your insurance provider or accessing it through their online platform. Then, enter the necessary details such as the policy number, your contact information, and the circumstances surrounding the claim. Following these steps as outlined in your SBLI Life Insurance Application will ensure a complete submission, allowing for quicker processing of your claim.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.