Loading

Get Irs Form 4782 1992-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 4782 online

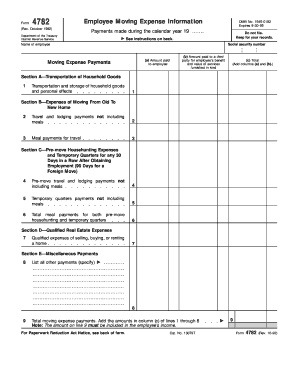

Filling out the IRS Form 4782 online is a crucial step for employers to document employees' moving expenses. This guide provides clear and comprehensive instructions to help you navigate each section of the form effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in the designated field as the employee for whom the moving expenses are being reported.

- Input the social security number of the employee directly into the appropriate field.

- For transportation and storage of household goods, enter the amounts paid to the employee and any amounts paid to third parties in the corresponding fields under Section A.

- In Section B, fill out the travel and lodging payments under the separate lines, including meal payments for travel.

- Section C captures pre-move expenses. Record the payments for pre-move travel, lodging, and meals in their respective fields.

- For qualified real estate expenses in Section D, fill out the relevant amounts associated with selling, buying, or renting a home.

- Section E is for miscellaneous payments. List additional payments not covered in previous sections.

- Finally, calculate the total moving expense payments by adding all amounts listed and enter this sum on the last line of the form.

- Review all completed fields for accuracy, then save changes. Options will be available to download, print, or share the completed form.

Complete your IRS Form 4782 online today to ensure accurate documentation of moving expenses.

To submit a corrected K-1 to the IRS, first, obtain the corrected K-1 form from the issuer. Then, file it as an attachment along with your tax return. It's essential to include IRS Form 4782 to ensure that everything aligns with IRS requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.