Loading

Get P9 Form 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P9 Form online

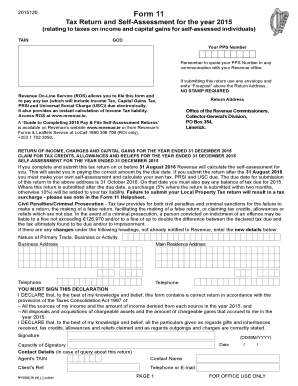

Filling out the P9 Form online is a crucial step for individuals responsible for self-assessment. This guide will provide you with a clear understanding of the form and its components, ensuring you complete it accurately and effectively.

Follow the steps to fill out the P9 Form online:

- Click the ‘Get Form’ button to access the P9 Form and open it in your preferred online editor.

- Begin by entering your Personal Public Service (PPS) Number in the designated field. This is essential for your identification in all communications with the Revenue office.

- Fill out the section requesting details about your income, charges, and capital gains for the relevant tax year. Ensure all income sources are accurately reported.

- Proceed to the tax credits, allowances, and reliefs section. Enter all claims you are eligible for, being careful to that each entry is correct.

- Fill in your bank details in the respective fields, as this information is necessary for any potential repayment.

- Complete personal details as required, including your civil status and changes in circumstances that may affect your tax obligations.

- Review and confirm all information you have entered. Verify that your declaration is signed and dated correctly.

- Once you have completed the form, you can save the changes, download it for your records, print it out if needed, or share the completed document as necessary.

Complete your P9 Form online today for a smooth filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To download the P9 form in PDF format, visit the US Legal Forms website. There, you can easily locate the P9 form and download it directly to your device. This user-friendly process ensures you have the necessary documentation ready for your tax needs without any hassle.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.