Get Za Sars Da 185

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA SARS DA 185 online

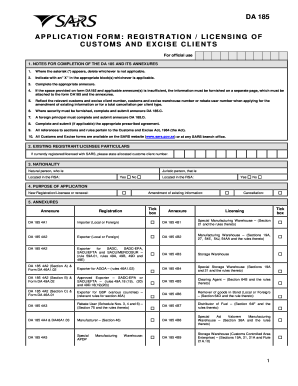

Filling out the ZA SARS DA 185 application form accurately is essential for the registration and licensing of customs and excise clients. This guide provides detailed instructions to assist users in completing the form online, ensuring that all necessary information is included.

Follow the steps to complete the ZA SARS DA 185 online efficiently.

- Click ‘Get Form’ button to access the form and open it in your editing platform.

- Begin by reviewing the notes for completion. Where applicable, delete options marked with an asterisk (*) and indicate your selections by placing an 'X' in the relevant blocks.

- For existing registrants, input your allocated customs client number. If you are not currently registered, proceed with the next sections.

- Indicate your nationality by selecting whether you are a natural or juristic person and if located in the Republic of South Africa (RSA).

- Clearly state the purpose of your application: whether it is for new registration or licensing, amendment of existing information, or cancellation.

- Check the boxes under annexures to indicate which documents are relevant to your application. Make sure to include any additional annexures listed.

- Fill in your business or personal particulars, including name, address, contact information, and bank account details if you have a local savings or cheque account.

- Provide your SARS revenue identification numbers, if applicable. Ensure accuracy to avoid delays.

- Detail the nature of your business, including the type of entity and registration numbers when required.

- Input the particulars of sole proprietors, directors, or partners as required. Include ID or passport numbers and relevant countries.

- Provide the public officer or representative's details, including contact information, and specify their capacity.

- Respond to questions regarding contraventions and other legal matters. If answering 'yes' to any, include detailed explanations on a separate page.

- Attach any documents in support of your application. Make sure these documents are current and meet the requirements.

- Complete the declaration section by signing and dating the application. Ensure your information is accurate and comprehensive.

- Finally, save your changes, download the completed form, and print or share it as needed to complete your submission.

Start filling out the ZA SARS DA 185 application form online today to ensure your compliance and efficiency in customs and excise processes.

A SARS administrative penalty is a financial penalty imposed for specific infractions related to tax compliance as defined by ZA SARS DA 185. It serves to reinforce the importance of following the tax regulations set by SARS. Understanding the nature of these penalties can help taxpayers avoid unnecessary costs and maintain a good standing with tax authorities. Tools and resources provided by USLegalForms can assist you in staying compliant and informed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.