Loading

Get Nv Detr Rpt5098

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV DETR RPT5098 online

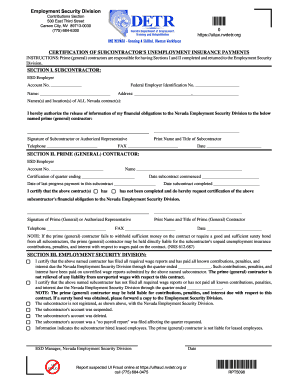

The NV DETR RPT5098 form is essential for subcontractors and prime contractors in Nevada to certify unemployment insurance payments. Understanding how to accurately complete this document is crucial for compliance with state regulations.

Follow the steps to fill out the NV DETR RPT5098 efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In Section I for the subcontractor, enter the ESD employer account number, federal employer identification number, and the name and address of the subcontractor. Provide the names and locations of all Nevada contracts, and authorize the release of information by signing and printing your name and title. Include your telephone and fax numbers, as well as the date.

- Move to Section II for the prime (general) contractor. Fill in the ESD employer account number, the name of the contractor, certification for the quarter ending, the date the subcontract commenced, and the date of the last progress payment. Indicate whether the subcontract has been completed and ensure to sign and print your name and title, along with your contact information and date.

- Review Section III, which is for the Employment Security Division, for statements regarding the contractor's compliance with wage reports and contributions. Ensure all necessary information is noted correctly. The ESD manager will fill out this section, so leave it blank.

- After completing all sections, make sure to save your changes. You can then download, print, or share the completed form as needed.

Complete your NV DETR RPT5098 online today to ensure compliance and streamline your submission process.

Employers in Nevada fund unemployment benefits through state-mandated taxes. This system ensures that unemployment compensation is available for workers who lose their jobs without fault. Staying informed about this process helps you understand your rights and responsibilities, especially with filings such as the NV DETR RPT5098.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.